UK Manufacturing Investment Outlook 2026: Why Surface Finishing Specialists Like Midland Deburr & Finish Are Positioned to Thrive

As UK manufacturing enters 2026, investment patterns across the sector reveal a story of cautious confidence rather than retreat. While capital expenditure remains selective, funding is increasingly being channelled toward areas that directly support productivity, automation and supply-chain resilience. One area quietly benefiting from this shift is industrial surface finishing — a discipline that sits at the intersection of quality, efficiency and downstream performance.

For Midland Deburr & Finish, based in Lye, Stourbridge, this changing investment landscape is reinforcing the strategic value of specialist subcontractors within modern manufacturing ecosystems.

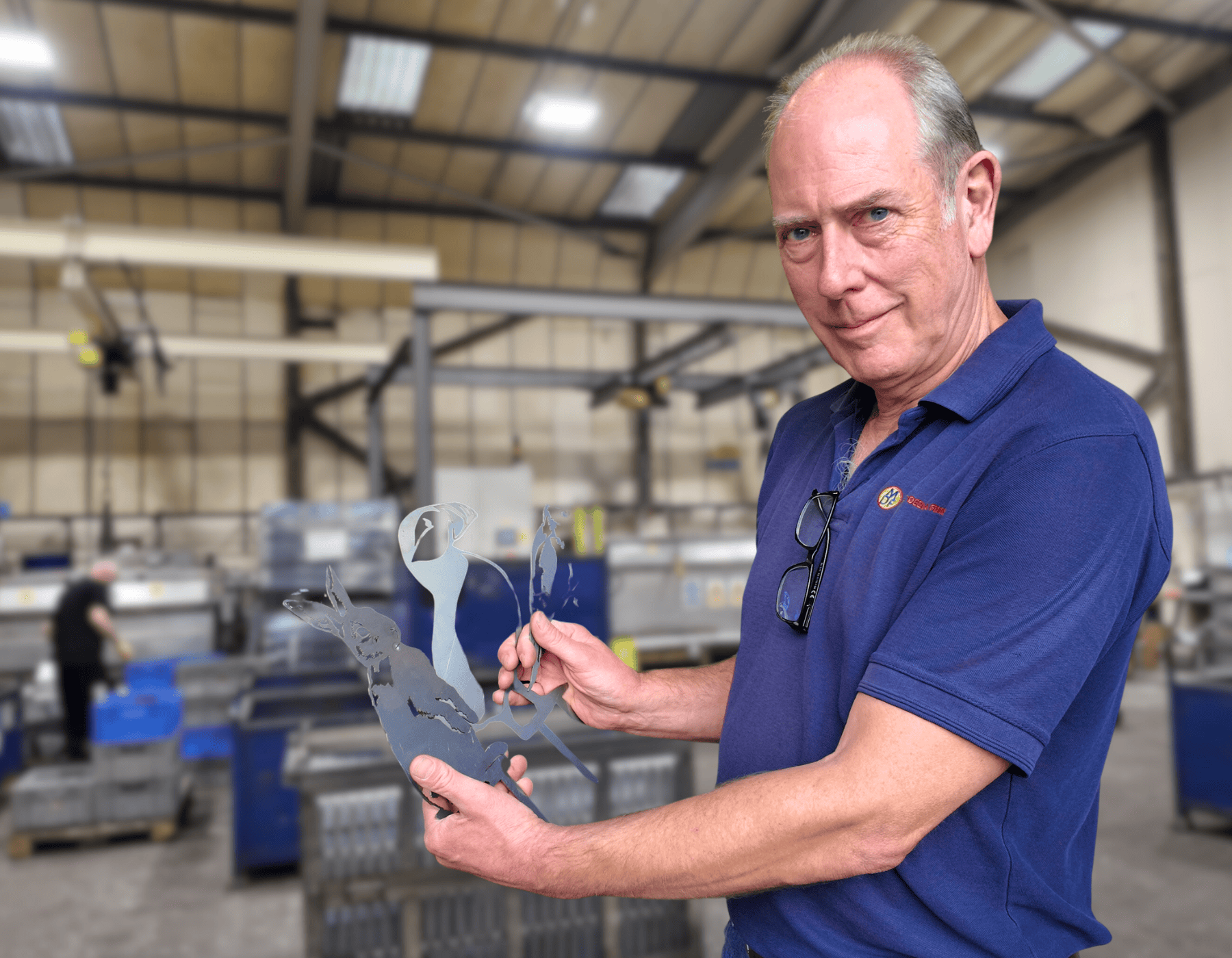

“Manufacturers are thinking much harder about where they place investment,” says Chris Arrowsmith, Managing Director of Midland Deburr & Finish. “There’s less appetite for speculative spend, but far more focus on processes that reduce risk, improve consistency and protect quality further down the line. That’s where surface finishing comes into its own.”

With energy costs stabilising but labour availability still tight, OEMs and Tier 1 suppliers are under pressure to extract more value from existing production lines. Rather than wholesale factory expansion, many are investing in automation, digital monitoring and process optimisation — trends that place greater emphasis on repeatable, high-quality finishing operations.

“In sectors like automotive, aerospace and electrification, it directly affects assembly reliability, coating adhesion and component life. If you get it wrong, the cost is felt much later — and much more expensively," Arrowsmith explains.

This has led to renewed scrutiny of subcontract partners, particularly those supporting safety-critical and regulated industries. Midland Deburr & Finish has seen growing demand for both deburring and degreasing services that align with tighter quality and traceability requirements.

As UK manufacturers balance reshoring ambitions with capital discipline, specialist subcontractors are increasingly viewed as investment multipliers — enabling customers to scale output or enter new markets without committing to heavy in-house spend.

“We’re seeing customers use specialists like us to de-risk growth,” says Arrowsmith. “Instead of buying new finishing equipment or expanding floor space, they’re outsourcing to partners who already have the capacity, the experience and the compliance in place.”

This approach is particularly evident in EV supply chains and aerospace component manufacturing, where finishing tolerances are becoming tighter as designs evolve and lightweight materials become more prevalent.

Looking ahead to 2026, Arrowsmith believes that resilience — rather than rapid expansion — will define successful UK manufacturers.

“The businesses that do well will be the ones that understand where they add value in the supply chain,” he says. “For us, that means continuing to invest in process capability, people and consistency, even when the wider market feels uncertain.”

He adds that surface finishing firms with diversified sector exposure are well placed to navigate uneven demand cycles.

“When one sector slows, another often picks up. Our job is to stay close to customers, understand what they need next, and be ready before demand arrives.”

While surface finishing may rarely grab headlines, its importance within modern manufacturing is becoming harder to ignore. As investment decisions tighten and expectations rise, companies like Midland Deburr & Finish are finding themselves not on the periphery of industrial strategy, but firmly at its core.

“In the end,” Arrowsmith concludes, “manufacturing investment only delivers returns if components perform as intended. Surface finishing is where a lot of that performance is either secured — or lost.”

For Midland Deburr & Finish, based in Lye, Stourbridge, this changing investment landscape is reinforcing the strategic value of specialist subcontractors within modern manufacturing ecosystems.

“Manufacturers are thinking much harder about where they place investment,” says Chris Arrowsmith, Managing Director of Midland Deburr & Finish. “There’s less appetite for speculative spend, but far more focus on processes that reduce risk, improve consistency and protect quality further down the line. That’s where surface finishing comes into its own.”

With energy costs stabilising but labour availability still tight, OEMs and Tier 1 suppliers are under pressure to extract more value from existing production lines. Rather than wholesale factory expansion, many are investing in automation, digital monitoring and process optimisation — trends that place greater emphasis on repeatable, high-quality finishing operations.

“In sectors like automotive, aerospace and electrification, it directly affects assembly reliability, coating adhesion and component life. If you get it wrong, the cost is felt much later — and much more expensively," Arrowsmith explains.

This has led to renewed scrutiny of subcontract partners, particularly those supporting safety-critical and regulated industries. Midland Deburr & Finish has seen growing demand for both deburring and degreasing services that align with tighter quality and traceability requirements.

As UK manufacturers balance reshoring ambitions with capital discipline, specialist subcontractors are increasingly viewed as investment multipliers — enabling customers to scale output or enter new markets without committing to heavy in-house spend.

“We’re seeing customers use specialists like us to de-risk growth,” says Arrowsmith. “Instead of buying new finishing equipment or expanding floor space, they’re outsourcing to partners who already have the capacity, the experience and the compliance in place.”

This approach is particularly evident in EV supply chains and aerospace component manufacturing, where finishing tolerances are becoming tighter as designs evolve and lightweight materials become more prevalent.

Looking ahead to 2026, Arrowsmith believes that resilience — rather than rapid expansion — will define successful UK manufacturers.

“The businesses that do well will be the ones that understand where they add value in the supply chain,” he says. “For us, that means continuing to invest in process capability, people and consistency, even when the wider market feels uncertain.”

He adds that surface finishing firms with diversified sector exposure are well placed to navigate uneven demand cycles.

“When one sector slows, another often picks up. Our job is to stay close to customers, understand what they need next, and be ready before demand arrives.”

While surface finishing may rarely grab headlines, its importance within modern manufacturing is becoming harder to ignore. As investment decisions tighten and expectations rise, companies like Midland Deburr & Finish are finding themselves not on the periphery of industrial strategy, but firmly at its core.

“In the end,” Arrowsmith concludes, “manufacturing investment only delivers returns if components perform as intended. Surface finishing is where a lot of that performance is either secured — or lost.”

Quick Contact Form